Netflix's acquisition of Warner Bros: What it means for viewers

- HOME

- ENTERTAINMENT

- Netflix's acquisition of Warner Bros: What it means for viewers

- Last update: 1 hours ago

- 3 min read

- 315 Views

- ENTERTAINMENT

Netflix revealed on Friday that it will purchase Warner Bros., the iconic Hollywood studio behind blockbuster franchises like "Superman," "Casablanca," and "Harry Potter," along with HBO, HBO Max, and a range of legendary TV shows including "Game of Thrones," "The Sopranos," and "The White Lotus." The $72 billion deal concludes a competitive bidding process that included media giants like Paramount and Comcast and follows Warners separation from its cable operations under Discovery Global, which encompasses Discovery Networks, CNN, TNT, and more.

In a statement, Netflix indicated it plans to "maintain Warner Bros. current operations and build on its strengths," but industry observers are debating what this will mean for the studios, their productions, and loyal audiences. As with any major corporate acquisition, the deal must pass regulatory approval, which could take 12 to 18 months.

Immediate Changes for Viewers

For now, consumers should not expect any immediate changes. Netflix has emphasized continuity while the transaction is under review by regulators.

Theatrical Releases

Netflix stated that it "expects" to continue Warner Bros. existing operations, including movie theater releases. However, Netflix's model typically favors streaming-first releases or brief theatrical runs primarily to qualify for awards. Warner Bros., known for box office hits like DC films and "Barbie," traditionally uses longer theatrical windows before moving to digital platforms. Netflix CEO Ted Sarandos suggested post-merger scheduling may become more consumer-friendly, though theater owners remain concerned about potential impacts on cinema attendance and revenue.

HBO Max and Netflix Streaming Strategy

While no formal plan has been announced to merge HBO Max with Netflix, the acquisition could lead to bundling content for subscribers, potentially offering more titles and flexible viewing options. Netflix argues this may lower costs for consumers, though reduced competition might also push prices up. If approved, Netflix would control two of the largest streaming services, challenging rivals like Disney+, Paramount+, Prime Video, Apple TV, and Peacock.

Impact on Warner Bros. Content

The merger is likely to influence the type of films and series produced by Warner Bros. Netflix may continue exploring adaptations, spin-offs, and new series leveraging Warners library. As seen with Amazons acquisition of MGM, new ownership can significantly shape programming decisions and content strategy.

Regulatory Hurdles

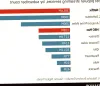

The acquisition is expected to face extensive regulatory scrutiny, both in the U.S. and internationally. Concerns have already been raised by competitors like Paramount, which criticized Warner Bros. Discoverys handling of the bidding process. Antitrust reviews will evaluate the combined companys control over a massive subscriber baseapproximately 430 million across Netflix and HBO Max.

Why Netflix is Buying Warner Bros.

The deal gives Netflix access to Warner Bros. vast content library, including classics like "Friends," "The Big Bang Theory," and Looney Tunes. Ownership of these shows allows Netflix to reduce licensing costs and strengthens its catalog for both nostalgic viewers and new audiences. In an era of mega-mergers, the acquisition underscores the drive for scale and content ownership in the competitive streaming landscape.

Author: Chloe Ramirez

Share

Elizabeth Warren Criticizes Netflix-Warner Bros Deal as a 'Nightmare of Anti-Monopoly'

28 minutes ago 2 min read BUSINESS

Is Netflix going to acquire CNN, HGTV & TLC?

1 hours ago 2 min read ENTERTAINMENT

European Cinema Owners Association Objects to Netflix and Warner Bros. Major Agreement

1 hours ago 2 min read ENTERTAINMENT

Netflix emerges victorious in competition for Warner Bros as HBO becomes part of streaming giant's empire

1 hours ago 2 min read ENTERTAINMENT

Ted Sarandos confirms Netflix's continued support for Warner Bros. movie releases, but with changes to release windows.

1 hours ago 1 min read ENTERTAINMENT

Netflix's Acquisition of Warner Bros. Sparks Competition Between WWE & AEW

1 hours ago 2 min read ENTERTAINMENT

European Cinema Association UNIC Criticizes Netflix-WB Deal as "Detrimental to Cinema in All Aspects" & "More Negative" Than Disney's Acquisition of Fox

2 hours ago 2 min read BUSINESS

Netflix to purchase Warner Bros. film studios, HBO, and HBO Max in a deal worth $82.7 billion

2 hours ago 2 min read ENTERTAINMENT

Netflix and Warner Bros. Studios reach $72 billion agreement

2 hours ago 1 min read ENTERTAINMENT

Netflix Plans to Continue Releasing Warner Bros. Films in Theaters

2 hours ago 3 min read ENTERTAINMENT